Tax Court Spotlight: Partner Titles Won’t Save You from Self-Employment Tax – The Soroban Ruling Under TEFRA and BBA

A recent decision in Soroban Capital Partners LP v. Commissioner (T.C. Memo 2025-52) is a powerful reminder for partnerships across investment, private equity, and professional services sectors: Federal tax law will look through legal titles and disregarded entities when determining tax liability.

The U.S. Tax Court held that three partners were not “limited partners as such” and were therefore subject to self-employment (SE) tax on their distributive shares of partnership income under IRC 1402(a)(13).

While the case involved 2016 and 2017 tax years, subject to the TEFRA audit regime, its implications extend to partnerships now governed by the Bipartisan Budget Act (BBA) centralized audit rules. No matter the regime, the court’s ruling will impact how partners are classified and taxed going forward.

The Central Issue: Are “Limited Partners” Exempt from Self-Employment Tax?

Under IRC 1402(a)(13), a limited partner’s distributive share of partnership income is excluded from self-employment (SE) tax, unless it represents guaranteed payments for services.

But Congress didn’t define “limited partner”, and courts have long filled the gap with a “functional test” – asking not what the partner is called, but what they do.

The three individuals at the center of the dispute were:

Eric Mandelblatt, through EWM1 LLC

Gaurav Kapadia, through GKK LLC

Scott Friedman, directly

The Functional Test: Economic Reality Over Legal Form

In Soroban, the Tax Court applied the “functional test” for determining whether a partner qualifies as a “limited partner” under IRC 1402(a)(13). The court determined that the three partners – although formally designated as limited partners under Delaware law – were:

Actively involved in investment decision-making

Essential to the firm’s performance and operations

Held out publicly as managing executives

Compensated based on their labor and investment returns

Thus, the court ruled they were not “limited partners as such” under IRC 1402(a)(13), and their entire share of flow-through income was subject to self-employment tax.

Public Representation Mattered

The court emphasized that Soroban’s partners were marketed as leaders in investor materials – identified by titles such as “Managing Partner” and “Chief Investment Officer”.

The public portrayal directly undercut the claim that they were passive, non-participatory limited partners.

TAKEAWAY: If a partner is essential to your brand, performance, and management, they likely fail the functional test for self-employment tax exclusion.

Disregarded Entities Don’t Shield You from Self-Employment Tax

Two of the three partners (Mandelblatt and Kapadia) held their interests through single-member LLCs, which are typically formed for liability protection or administrative convenience.

But for federal tax purposes, SMLLCs are “disregarded entities” under Treas. Reg. SS 301.7701-2(c)(2)(i). That means:

The income, activity, and tax responsibility flows directly to the individual owner

The LLC wrapper is ignored for purposes of calculating self-employment tax

For self-employment tax, this is especially critical: If the owner of the SMLLC is an individual, and the LLC is engaged in a trade or business, the owner owes self-employment tax on the LLC’s net earnings.

As the court put it:

“It is precisely because federal tax law must look to the economic realities of the arrangement – not merely the state law structure – that self-employment tax applies here.”

This is a critical takeaway: If you’re an active partner, placing your ownership in an SMLLC does not exempt you from self-employment tax. The IRS will still treat it as your income.

Estimated Self-Employment Tax Impact Under TEFRA

Soroban’s audit years (2016 and 2017) fell under TEFRA, which meant that while the IRS could audit the partnership centrally, any resulting adjustments flowed through to the individual partners via corrected K-1s.

Let’s break it down in simple terms:

Adjusted Income by IRS (Per Tax Court Opinion):

2016: $77.6

2017: $63.9M

Estimated Self-Employment Tax (at 15.3%):

2016: $2.1 million

2017: $1.8 million

Estimated Additional Medicare Tax (at 0.9%)

2016: $694K

2017: $569K

Under TEFRA, each partner would be required to amend their 2016 and 2017 tax returns and pay the additional SE tax of approximately $1.29M plus another $421K for additional Medicare tax, along with interest and any penalties imposed. This outcome is painful – but it’s amplified under BBA.

What If This Were a BBA-Year Audit?

Since Soroban’s audited years (2016-2017) were governed by TEFRA, each partner would receive an adjusted K-1 and owe the self-employment tax individually.

But under the Bipartisan Budget Act (BBA), which applies to years beginning 2018 and later, the IRS could assess the tax directly to the partnership unless it made a push-out election under IRC 6226.

Hypothetical Under BBA

Let’s assume Soroban’s 2016 and 2017 incomes were audited under the BBA:

Adjusted Income by IRS (Per Tax Court Opinion):

2016: $77.6M

2017: $63.9M

Imputed Tax (at 37%):

2016: $28.7 million

2017: $23.6 million

Without a timely push-out election, Soroban (as a partnership entity) would be liable for a $50M+ tax bill, plus interest and penalties. This payment would not be allocated to the partners, creating real tension if partners have since left, died, or sold interests.

The Soroban facts underscore the BBA’s power: massive reclassification + centralized liability = major exposure.

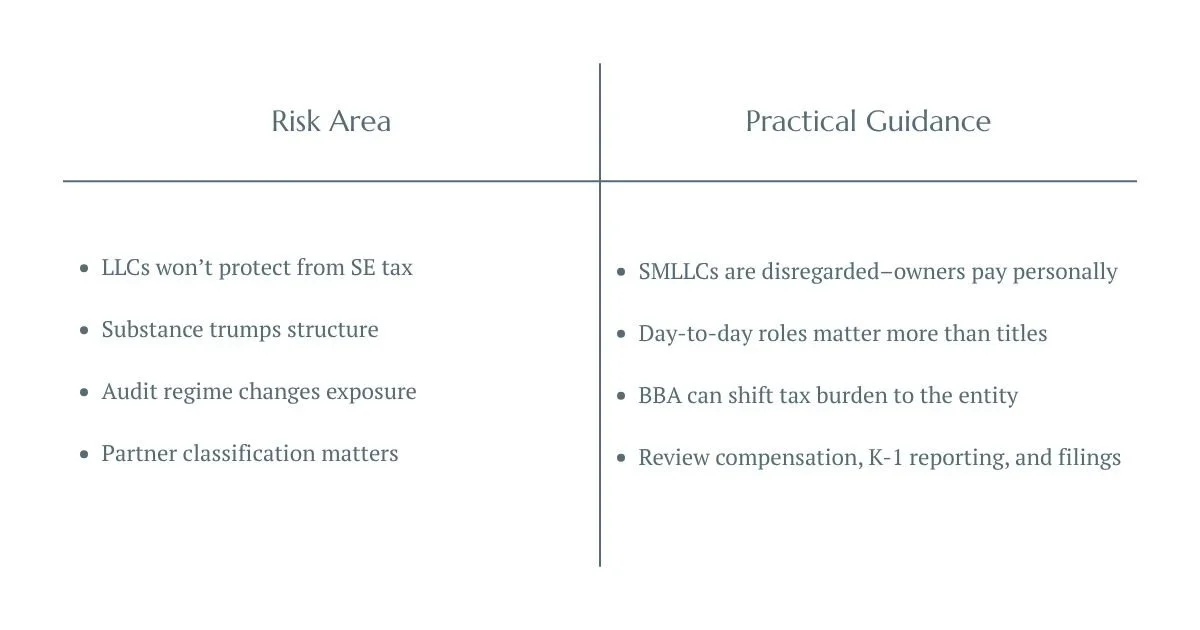

Why This Ruling is Impactful Regardless of the Regime

Whether under TEFRA (retroactive K-1 adjustments) or BBA (entity-level assessments), the court’s logic holds:

Partner classification hinges on function, not title

Active, service-providing partners will be subject to SE tax

State law “limited partner” status doesn’t protect you under federal tax law

This is especially important for partnerships in investment management, professional services, and private equity, where operational partners often hold limited partner interests but perform high-value labor.

Strategic Considerations

Review partner responsibilities: Are limited partners materially participating in operations?

Align marketing with tax structure: Don’t promote limited partners as executives if you’re excluding self-employment tax.

Address BBA in your partnership agreement: Include push-out language and Partnership Representative appointment clauses.

Consider compensation structure: Guaranteed payments vs. profit distributions = tax treatment shift.

Plan exit strategies for past-year partners: Avoid “stuck” liability under BBA rules.

Key Lessons for Partnerships

Final Thoughts

The Soroban case is more than a self-employment tax dispute – it’s a case study in substance-over form and a sharp reminder that audit outcomes are shaped as much by operational facts as they are by entity documents.

Partnerships must now be more diligent than ever: If you’re using “limited partner” status to claim tax benefits, make sure the partner truly behaves like one – because the IRS and the courts are looking past the label.

Resources

IRC §1402(a)(13) – Self-Employment Tax Exception for Limited Partners

Soroban Tax Court Ruling (T.C. Memo 2025-52)